In the stock market, success does not belong to the fastest trader or the loudest market commentator. It belongs to the disciplined investor who understands structure, sequence, and probability.

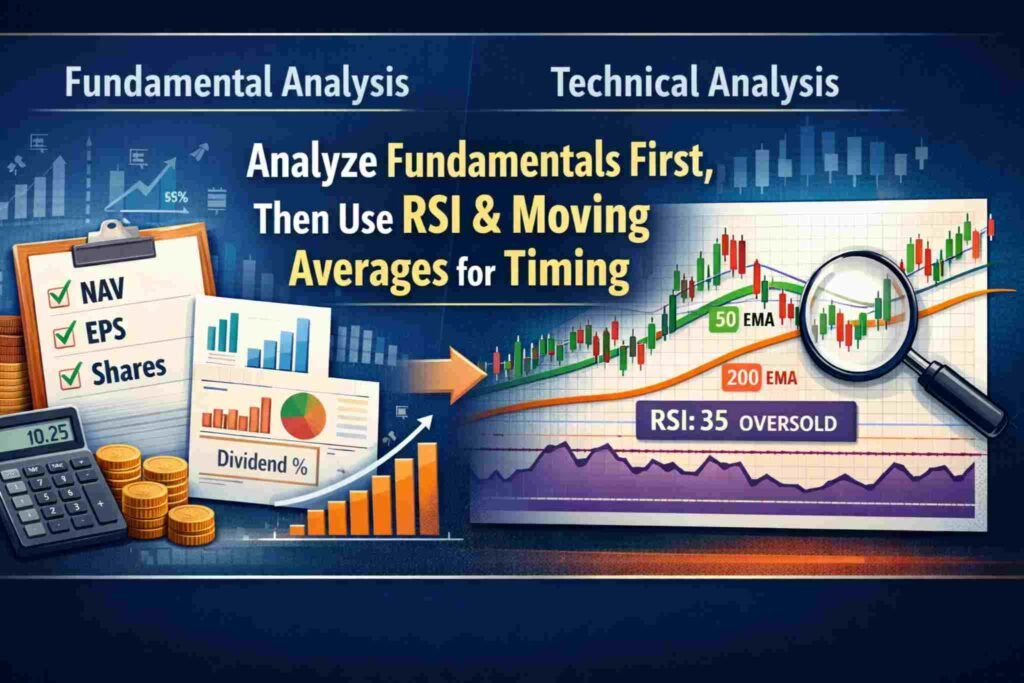

Many people enter the share market with excitement but without a system. Some focus only on charts and technical indicators. Others read financial reports but ignore timing. Both approaches are incomplete.

The intelligent formula for sustainable profit is simple:

First analyze the company’s fundamental strength.

Then apply technical tools like RSI and Moving Averages for precise timing.

This structured combination transforms speculation into calculated investing.

Part 1: Fundamental Analysis — Protecting Capital Before Seeking Profit

Before studying price charts, an investor must ask:

Is this company financially strong enough to deserve my capital?

When you buy a stock, you are not buying a number on a screen. You are buying partial ownership in a business. That business must have assets, profitability, and structural stability.

Let us examine the most critical fundamental pillars.

1. NAV (Net Asset Value) — The Margin of Safety Indicator

NAV represents the book value of a company per share. It is calculated by subtracting total liabilities from total assets and dividing the result by total outstanding shares.

NAV gives insight into the underlying asset base of the company.

If a stock’s market price is significantly below its NAV, the company may be undervalued — assuming the assets are productive and earnings are healthy.

However, NAV alone is not enough. Some companies have strong assets but weak profitability. Therefore, NAV must be evaluated alongside earnings strength.

For intelligent investors, NAV acts as a capital protection benchmark. It provides a cushion against overpaying.

2. EPS (Earnings Per Share) — Measuring Profit Power

EPS shows how much net profit the company generates for each outstanding share.

This is one of the most important indicators of business health.

A strong company demonstrates:

- Consistent EPS growth over 3–5 years

- Stability during economic downturns

- Sustainable profit margins

Short-term earnings spikes can be misleading. What matters is consistency.

Growing EPS indicates operational efficiency, market demand, and effective management. Declining EPS signals structural problems.

A company without earnings growth cannot sustain long-term price appreciation.

3. Share Structure — Understanding Dilution Risk

One of the most overlooked factors in investing is total number of shares.

When companies issue excessive shares, existing shareholders’ earnings become diluted. Even if total profit increases, EPS may stagnate due to higher share count.

Investors must evaluate:

- Has the company frequently issued bonus shares?

- Is there continuous rights offering?

- Is share dilution affecting EPS growth?

A disciplined share structure protects shareholder value. An undisciplined one weakens it.

Understanding share supply also explains price behavior. Companies with extremely large outstanding shares may experience slower price movements due to supply pressure.

4. Dividend Discipline — Cash Flow Strength

Dividends are not just income; they are evidence of financial strength.

Consistent dividend payments demonstrate:

- Stable cash flow

- Responsible management

- Long-term sustainability

Dividend yield, calculated as annual dividend divided by current price, also provides partial downside protection.

Companies that can reward shareholders while reinvesting for growth are structurally strong businesses.

5. Debt and Financial Stability

Profit alone does not guarantee safety. Debt level determines resilience.

Investors should examine:

- Debt-to-equity ratio

- Interest coverage ratio

- Cash flow from operations

High debt increases vulnerability during economic slowdown. Low debt combined with steady earnings creates stability.

Financial strength reduces the risk of sudden collapse.

The Fundamental Screening Summary

Before even opening a chart, the intelligent investor confirms:

- Strong NAV relative to price

- Consistent EPS growth

- Controlled share dilution

- Stable dividend record

- Manageable debt level

Only after these conditions are met should technical analysis begin.

Part 2: Technical Analysis — Optimizing Entry and Exit

Fundamentals determine what to buy.

Technical analysis determines when to buy.

Even the strongest company can deliver poor returns if purchased at the wrong price.

Timing improves probability.

Two powerful tools for investors are:

- Moving Averages

- RSI (Relative Strength Index)

Moving Averages — Identifying Trend Direction

Moving averages smooth price data and reveal trend direction.

Long-term investors commonly use:

- 50-day Exponential Moving Average (EMA)

- 200-day Exponential Moving Average (EMA)

When price remains above the 200 EMA, it indicates long-term bullish structure.

When the 50 EMA crosses above the 200 EMA, it forms what is known as a “Golden Cross,” signaling strengthening momentum.

Buying fundamentally strong stocks during confirmed uptrends significantly increases probability of success.

Conversely, purchasing below major moving averages increases downside risk.

Trend alignment is essential.

RSI (Relative Strength Index) — Momentum Timing

RSI measures price momentum on a scale from 0 to 100.

- Below 30 → Oversold condition

- Above 70 → Overbought condition

However, RSI must be interpreted within context.

In a strong uptrend, RSI often pulls back to 35–45 before resuming upward movement. This zone frequently offers intelligent entry opportunities.

Buying when RSI indicates temporary weakness within a strong trend allows investors to avoid overpaying.

RSI also helps detect divergence. If price makes a lower low while RSI makes a higher low, it may indicate weakening selling pressure.

Momentum confirmation improves entry accuracy.

The Intelligent Combination Strategy

The true power lies in integration.

Step 1: Screen companies based on fundamentals.

Step 2: Wait for price to align above long-term moving averages.

Step 3: Enter when RSI indicates controlled pullback near support.

Step 4: Manage risk through diversification and position sizing.

This sequence prevents emotional decisions.

Why This Method Outperforms Emotional Investing

Investors who rely only on charts risk buying fundamentally weak companies.

Investors who rely only on fundamentals risk buying during overvaluation peaks.

The integrated method solves both problems:

- Fundamentals protect capital.

- Technical timing improves efficiency.

This approach reduces:

- Large drawdowns

- Panic selling

- Overpaying during hype

- Long stagnation periods

Discipline converts volatility into opportunity.

Risk Management — The Foundation of Survival

No strategy eliminates risk entirely.

Intelligent investors:

- Diversify across sectors

- Avoid concentrating capital in one stock

- Limit position size

- Avoid leverage without expertise

- Think in probabilities, not certainty

Even strong companies experience corrections. Patience and risk control separate professionals from gamblers.

A Practical Example

Imagine a company with:

- Five-year EPS growth averaging 12%

- Stable dividend payments

- Low debt ratio

- Price slightly above NAV

Technically:

- Price trades above 200 EMA

- 50 EMA trending upward

- RSI at 38 after pullback

This alignment suggests both structural strength and favorable timing.

Such entries increase probability of profitable outcomes over the long term.

Long-Term Wealth Creation Mindset

The stock market rewards:

- Consistency

- Patience

- Structured thinking

- Emotional control

Short-term speculation may generate excitement. Structured investing builds wealth.

Compounding multiplies disciplined decisions over time.

Final Principle

The intelligent formula for profitable stock market investing is built on sequence:

Analyze the business.

Confirm the trend.

Time the entry.

Manage the risk.

When fundamentals and technical timing work together, investing becomes strategic rather than emotional.

This method does not promise overnight riches. It builds sustainable growth.

Strong businesses generate earnings.

Smart timing optimizes price.

Discipline protects capital.

Together, they create long-term success in the share market.